Last Updated on May 26, 2024 by Daniele Lima

Unveiling intelligent passive and active income strategies to build wealth and achieve the financial independence you dream of

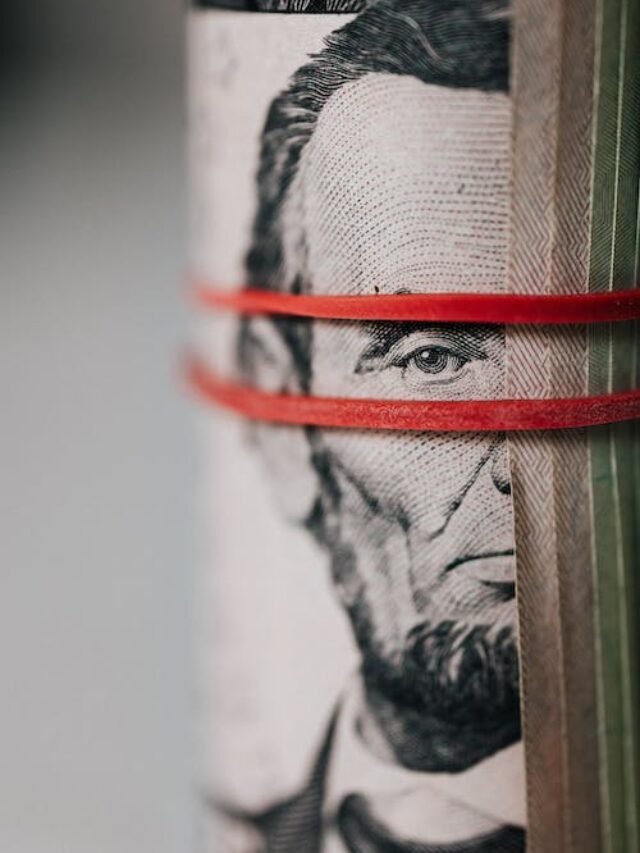

In the incessant search for financial stability and independence, exploring the nuances between passive and active earnings becomes an essential journey for any individual who aims to build a solid and prosperous future. In this article, we will explore the fascinating universe of finance by uncovering the secrets behind two crucial concepts: passive income and active income.

The differences between these forms of income go far beyond simply receiving money, as you can see in the article on the website. It transposes investment strategies, entrepreneurial mentality, and a deep understanding of the opportunities that the financial world offers.

By understanding the dynamics between passive and active income, we empower ourselves to create an inclusive approach toward enrichment, shaping our financial destiny in a unique and personalized way.

In the midst of an economic scenario in constant metamorphosis, understanding how these two types of income interact and complement each other is crucial for anyone who wants to follow a solid path toward prosperity. Get ready to immerse yourself in a deep dive into the world of finance, where we will uncover the secrets behind each type of income and explore how to integrate them strategically, with the aim of achieving lasting financial stability.

Table of Contents

Active Income:

Active income refers to financial gains from a person’s work or professional activity. In contrast to passive income, which is generated by investments and sources that do not require ongoing active participation, active involves ongoing effort and direct work to earn.

There are several forms of active income, such as salaries, professional fees, commissions, and income from own businesses. The main characteristic is that to earn money, constant effort is required, whether through working hours, specialized skills, or the provision of services.

The concept of active earnings highlights the importance of direct involvement in generating income. That includes professionals salaried employees, freelancers, entrepreneurs, and self-employed professionals. Those people count on their active participation in their activities to get rewards financially.

One of the advantages of this is that you have control straight over your finances which is directly linked to your effort and performance. However, a disadvantage they are as the limitations of time. That is why many active earnings models are tied to the time of work. This can make it difficult to expand and the creation of streams that do not are directly related to your commitment of time.

Simply put, active income is something that originally you earned by working or giving a service, It requires continuous effort to generate income. For many people, It is It is an aspect essential and your financial life and plays a role in the construction of your career and obtaining security economic. Here Here are some examples of active income:

Regular Salary:

Salaried professionals receive a salary in exchange for hours worked at their regular jobs. This is a classic example of active income. Fees

Professionals:

Lawyers, doctors, accountants, or other independent professionals may receive compensation for services provided to clients.

Sales Commission:

A sales representative who receives a commission based on sales performance. The more sales you successfully close, the higher your active earnings will be.

Entrepreneurship Income:

Small business owners, such as stores, restaurants, or service companies, generate active income from the daily operations of their enterprises.

Freelance work:

A graphic designer, freelance writer, programmer, or any independent professional can earn money based on the projects they complete for clients.

Service Professionals:

People who provide specialized services, such as coaching, consulting, and personal training, receive direct compensation for the services provided.

Artists and Performers:

Musicians, actors, and visual artists, among others, earn money through performances, sales of works of art, or entertainment contracts.

Real Estate Brokers:

They earn commissions based on the real estate transactions they are able to facilitate.

Bloggers and Content Creators:

Those who make money through blogs, online videos, and podcasts, among others, generate active earnings through content creation.

Freelance IT Professionals:

Programmers, web developers, and other technology professionals who offer their services independently.

These are just a few examples, and the diversity of occupations reflects the variety of ways active earnings can be earned. Each of these cases involves a direct and continuous effort to generate revenue.

Active income generating strategies:

Investing in training and professional development is important to enhance your active income. Learning the latest technologies and pursuing career advancement opportunities can increase your salary. Additionally, running and starting your own business is a way to create a significant source of active earnings, although it requires a lot of initial effort.

Diversifying your sources of income is also a wise strategy. Relying solely on paid work can increase financial vulnerability in times of economic instability. Taking part in side hustles like freelancing, consulting, or self-employment can provide an additional layer of financial security.

Passive Income:

This type of income refers to benefits financials that do not require continuous active participation. Examples include rental income, dividends in actions, royalties, etc. This is a way to build wealth with less effort It is to guarantee the stability long-term financial situation. Diversifying your passive earnings sources can be an effective strategy to increase your financial security.

Investing in assets such as rental properties, stocks that pay consistent dividends, and creating digital products for royalties are ways to generate passive income. This approach allows you to earn money even when you are not actively working, giving you financial freedom and flexibility.

However, to make an informed decision, it is important to carry out in-depth research and understand the risks associated with each type of investment. Carefully building a passive income portfolio can be a key element of yours. Here are some examples of passive income:

Property for rent:

Owning a rental property is a classic form of passive income. The monthly rent generates a constant cash flow, providing a financial return to the owner.

Dividends on Shares:

Investing in shares of companies that pay regular dividends allows shareholders to receive a portion of the company’s profits, providing a source of passive income.

Real Estate Investment Fund (FII):

FII is an option to invest in real estate without acquiring physical assets. They share a portion of the income generated by renting the fund’s assets.

Fixed income securities:

Some types of securities, such as notes and some types of bonds, pay interest periodically, providing investors with a form of passive income.

Affiliate Marketing:

For those active online, affiliate marketing can be used to generate passive income. Promote third-party products and earn commissions on sales through your affiliate link.

Digital content creation:

Creating and selling books, online courses, music, or other digital content can generate long-term royalties for passive income. This is just one example and the effectiveness of passive income depends on proper investment management and understanding the different funds available.

Passive Income Development Strategies:

Building passive income requires solid investment knowledge. Investing in dividend stocks, building a diversified investment portfolio, purchasing rental properties, and exploring real estate investment opportunities are effective ways to develop passive income. Careful management of these assets is essential to ensure consistent returns.

Technology and innovation provide additional opportunities to generate passive income, including monetizing blogs, video channels, and online content creation. Intellectual property, such as books, music, and patents, can also generate royalties over time.

The role of diversity:

The diversification of active and passive income is a fundamental risk reduction strategy. Multiple sources of active and passive income can provide protection against economic fluctuations, job market changes, and other unexpected events.

Challenges and ethical considerations:

When trying to build a passive income, it is important to be aware of the risks associated with investing. Knowledge of financial markets, careful analysis of investment opportunities, and consultation with financial experts are prudent practices.

Ethical considerations also play an important role. Choosing to invest in companies or industries that align with your personal values can be an important approach to building a sustainable passive income portfolio.

Conclusion:

In short, passive and active earnings seeking are not mutually exclusive. They both play complementary roles in a person’s financial journey. To achieve financial security and freedom, it’s important to find the right balance between these types of income to fit your specific goals and circumstances. In short, the idea is for you to work intelligently on both ends.

From the moment you understand this concept, you will understand the solidity of the interaction of these two financial poles. The path is personalized for each person to achieve financial independence, but smart integration of active and passive income is a consistent way to reach your long-term financial goals.

Passive And Active Income – FAQ:

What is active fixed income

Fixed income is income from financial instruments that require management and effort, usually through investments such as bonds or savings accounts. Unlike passive income, fixed income requires greater involvement in maintenance, repairs, and reinvestment. For example, successful fund management requires business managers to constantly analyze business conditions, adjust assets, and respond to changes in the business to achieve successful results.

This contrasts with ordinary income, where investments are made with minimal intervention, such as buying bonds and holding them to maturity. Fixed income strategies aim to outperform benchmarks and deliver higher returns, but they also introduce higher risks and require expertise to respond to technical implications.

What are some ways to make passive income

There are many strategies for generating income that allow you to make money with minimal effort. Investing in rental property is one way to generate rental income. Stock dividends are another option where you can earn a portion of your company’s profits. Real estate investment trusts (REITs) provide a way to invest in real estate without physical assets and share the income from the investment.

Fixed-income bonds, like bonds, offer regular interest. Additionally, creating digital content such as e-books or online courses can incur expenses over time. Affiliate marketing allows you to make money by promoting third-party products online. Diversifying your passive income can increase financial stability and growth.

When is rental income not passive

Rental income is not considered passive income if the owner is involved in the management and operation of the rental property. This will include tasks such as finding tenants, maintenance and repairs, collecting rent, and managing day-to-day problems. If the owner’s involvement is significant and continuous, income from rent varies from passive to active. For example, landlords who actively manage multiple rental properties, manage tenants and maintain the property generate income from these efforts. This involvement requires the same time and effort as a business, the difference is in the actual income, where the employer is the real estate manager and there is very little outright involvement.

Leave a Reply